Bitcoin faces greater downside risk than Ethereum- Here’s why

The entire cryptocurrency market has been registering selling pressure while the discovery of the ‘bottom’ continues. Amid the bearish price action, more than 62,000 traders were liquidated in the last 24 hours of 13 July as per data from CoinGlass. Additionally, over $180 million was liquidated over the same period.

Battle of the bearsThe end of the bull market and the collapse of the top projects have caused enormous losses. The overall performance of the crypto-asset market has remained at a low level since the beginning of 2022.

The top two cryptocurrencies, Bitcoin [BTC] and Ethereum [ETH] respectively, have suffered the wrath of the market. To add to it, the price of BTC has fallen by more than 70% from its all-time high, while the price of ETH has fallen by more than 75% from its all-time high. That being said, the former continues to face greater downside risks.

The additional pressure from investors’ heavy buying of put options is one of the reasons for the price movements in the cryptocurrency market.

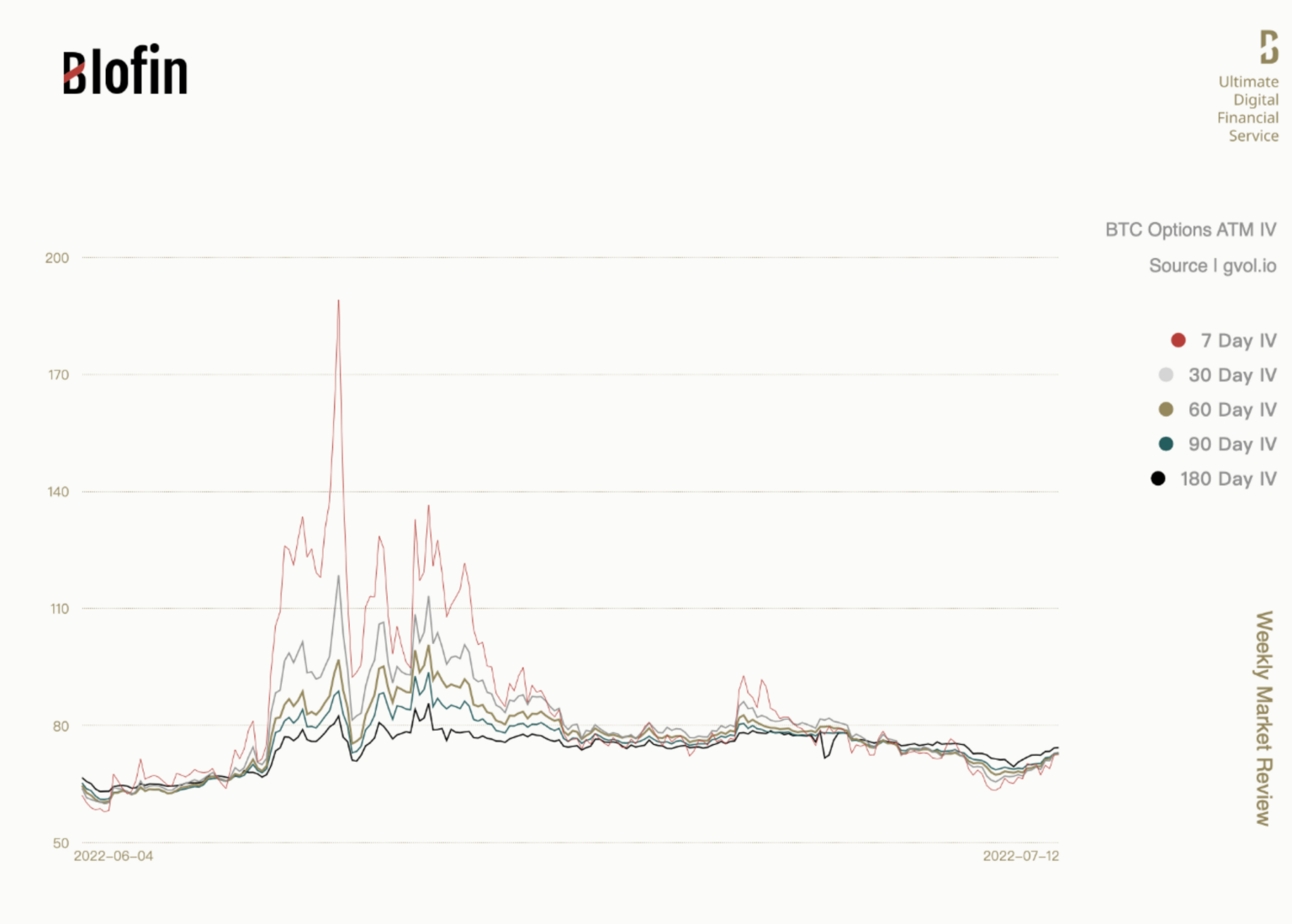

One might wonder about the reason for the unprecedented price fall. Well, the immense selling triggered by the liquidation of institutions has given way to it. The graph given below highlights this scenario for the largest cryptocurrency.

In this regard, a medium (publishing platform) blog on a weekly crypto market review stated,

“The continuous wave of selling triggered by the liquidation of institutions had a significant impact on the derivatives market, driving the risk aversion sentiment to remain high for a long time. The inversion of the volatility surface is one manifestation of risk aversion.”

In addition to this, the analysis of the blog further expanded on the ‘gamma exposure’ for BTC as compared to ETH.

Persistent negative gamma exposure means that any hedging by option sellers as prices fall will generate additional selling pressure, further pushing up the overall risk level in the crypto market.

Consider the graph below, exposure to BTC is not effectively controlled here.

On the other hand, ‘exposure to ETH is well controlled,’ the blog asserted. Ergo, offsetting the possibility of additional selling pressure.

On a neutral note?The crypto market has seen patterns of high mentions of peak bearishness happening after prices have fallen, and just before prices flatten out or reverse. This meant that the bear market consciousness has declined significantly since last month, as traders took on a more neutral tone.

Source : ambcrypto